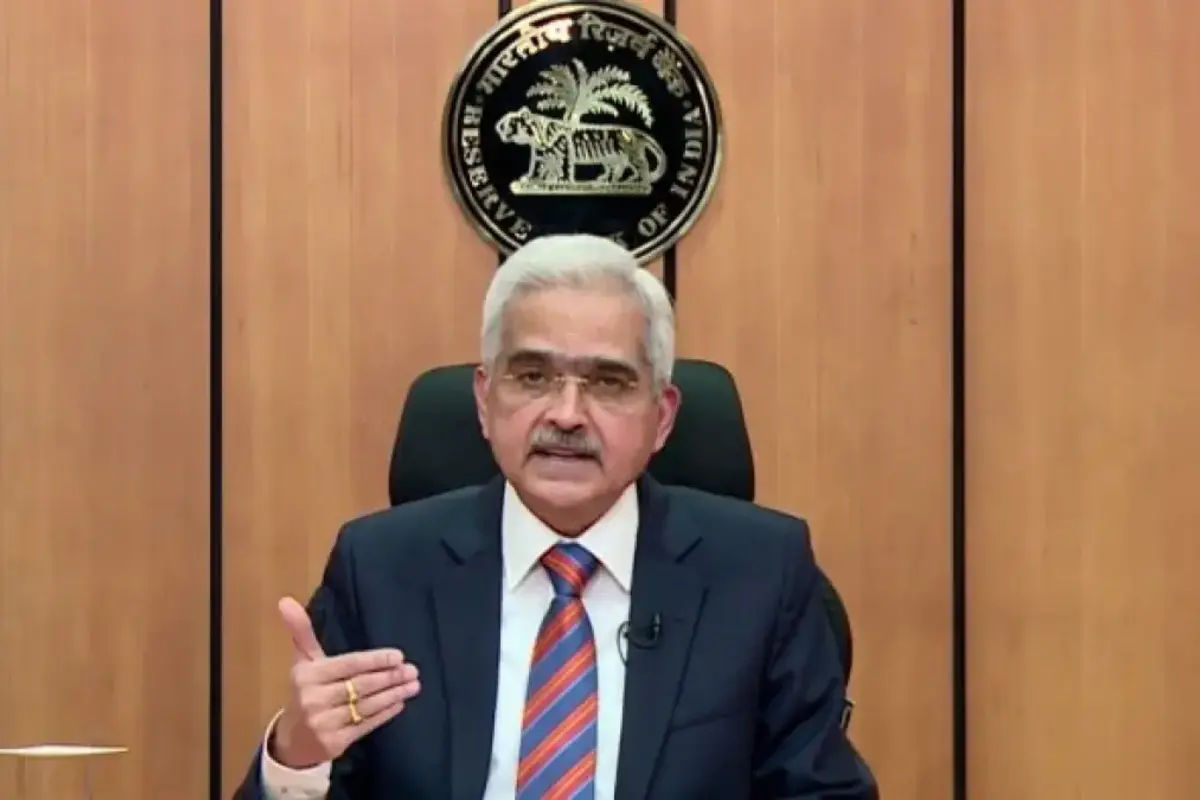

RBI Governor Shaktikanta Das

The Reserve Bank of India’s statement on Thursday about the addition of conversational payments and offline capability to UPI Lite signals a watershed moment in India’s economic trajectory.

The central bank increased the UPI lite payment limit from Rs 200 to Rs 500.

According to RBI Governor Shaktikanta Das, it is proposed to (i) enable Conversational Payments on UPI, which will enable users to engage in conversation with AI-powered systems to make payments; (ii) introduce offline payments on UPI using Near Field Communication (NFC) technology through ‘UPI-Lite’ on-device wallet; and (iii) increase the transaction limit for small value digital payments in offline mode. These measures would broaden the reach and use of digital payments in the country.

The roll-out of conversational payments via UPI is an important concept. Users will be able to initiate and authorize transactions using natural language interactions, making the payment process easier and more convenient.

The Reserve Bank of India unanimously opted to leave the repo rate constant at 6.5 percent at its three-day monetary policy committee meeting, as most financial markets expected.

Also read: Explosion In Moscow Factory Leaves 1 Dead, More Than 50 Hurt

To read more such news, download Bharat Express news apps