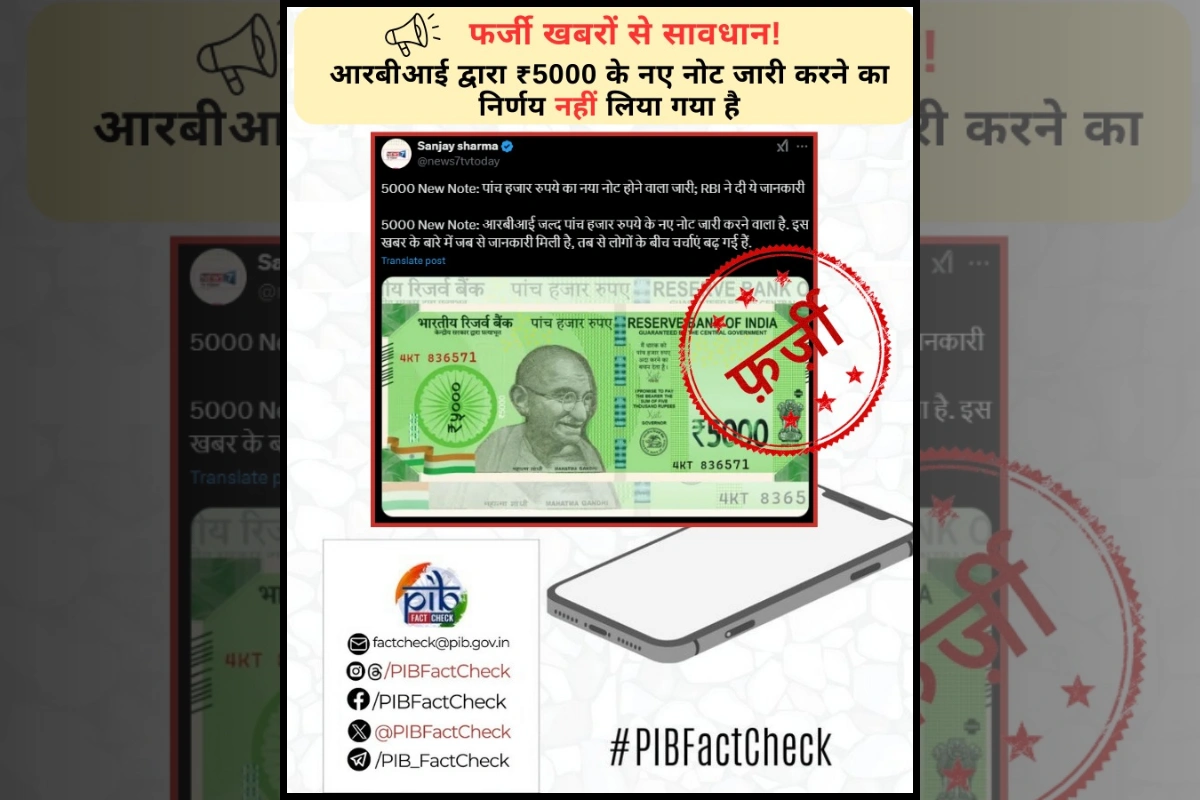

Government Debunks Rumours Of New ₹5000 Banknote

Government clarifies that social media claims about the introduction of a new ₹5000 currency note are false, urging citizens to rely only on official RBI updates.

PIB Warns Public Against Fake RBI Voicemail Threatening Bank Account Block

The Press Information Bureau’s fact-check unit has warned citizens about a scam voicemail falsely claiming to be from the Reserve Bank of India, urging people to verify suspicious government-related content through official channels.

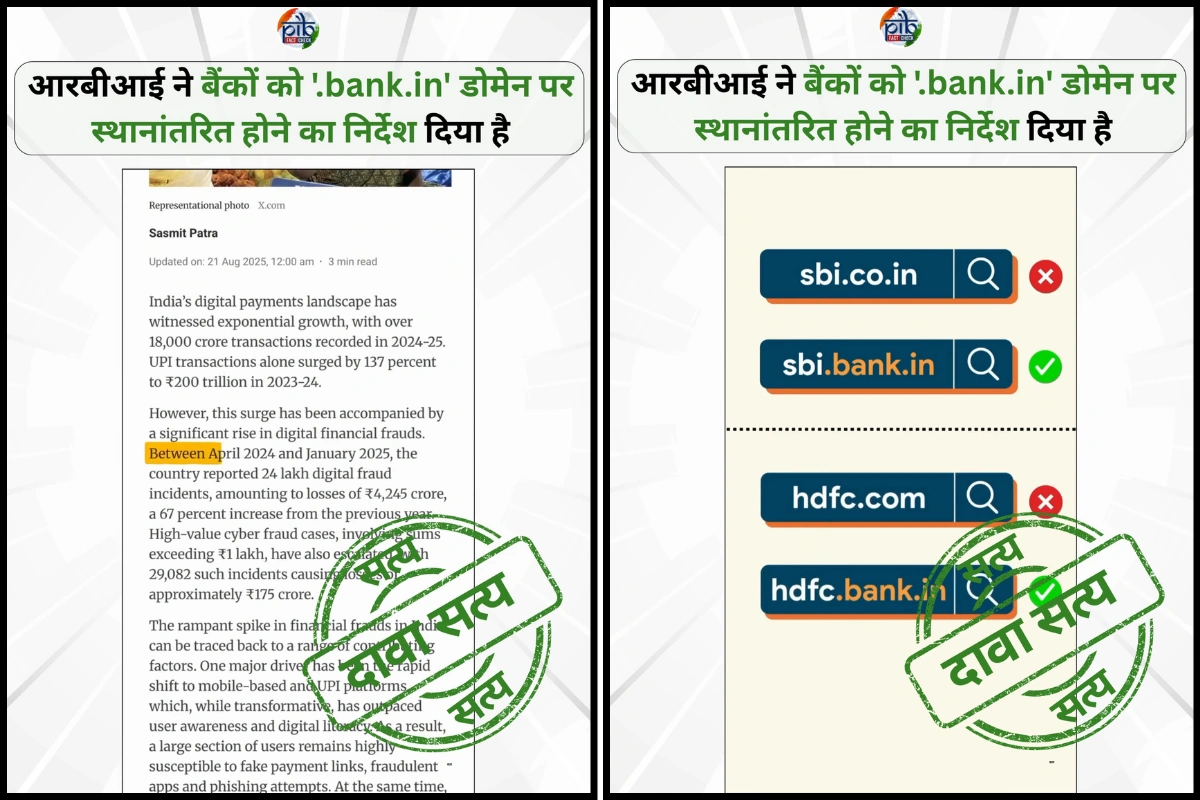

RBI Directs All Banks To Shift To ‘.bank.in’ Domain By October 2025

RBI directs all Indian banks to migrate to the ‘.bank.in’ domain by October 2025 to improve online security, with IDRBT appointed as the exclusive registrar.

Sensex And Nifty Rebound After Three-Day Slump As IT And Auto Stocks Lead Gains

Indian markets recovered after a three-day decline, driven by gains in IT and auto stocks, amid optimism over the US government shutdown resolution.

Explainer: How The Washington Post’s Article On LIC-Adani Link Spins False & Misleading Narratives

Government and experts firmly dismiss the Washington Post’s LIC-Adani claims as false and politically motivated.

RBI Fixes Early Exit Price For SGB Series-VII; Five-Year Returns Soar 153%

RBI announces early redemption for SGB Series-VII, giving investors 153% returns and tax-free benefits.

RBI Decision Lifts Markets As Sensex Gains 715 Points; Nifty Above 24,800

Indian stock markets rise sharply as Sensex and Nifty rebound after RBI holds repo rate at 5.5% and upgrades GDP forecast to 6.8% for FY26, ending an eight-day losing streak.

RBI Expands Measures To Boost Rupee Global Role In Trade & Finance

RBI takes new steps to internationalise the rupee, enabling INR lending abroad, expanding SRVA use, and publishing more forex rates.

RBI Raises India’s GDP Growth Forecast To 6.8% For 2025-26

The Reserve Bank of India (RBI) raised India’s GDP growth projection for 2025-26 to 6.8 per cent, up from its earlier forecast of 6.5 per cent.

Indian Equity Markets End Marginally Lower Ahead Of RBI Policy Decision

Sensex and Nifty closed slightly lower on cautious trading ahead of the RBI’s upcoming monetary policy announcement, with mixed sectoral performances.