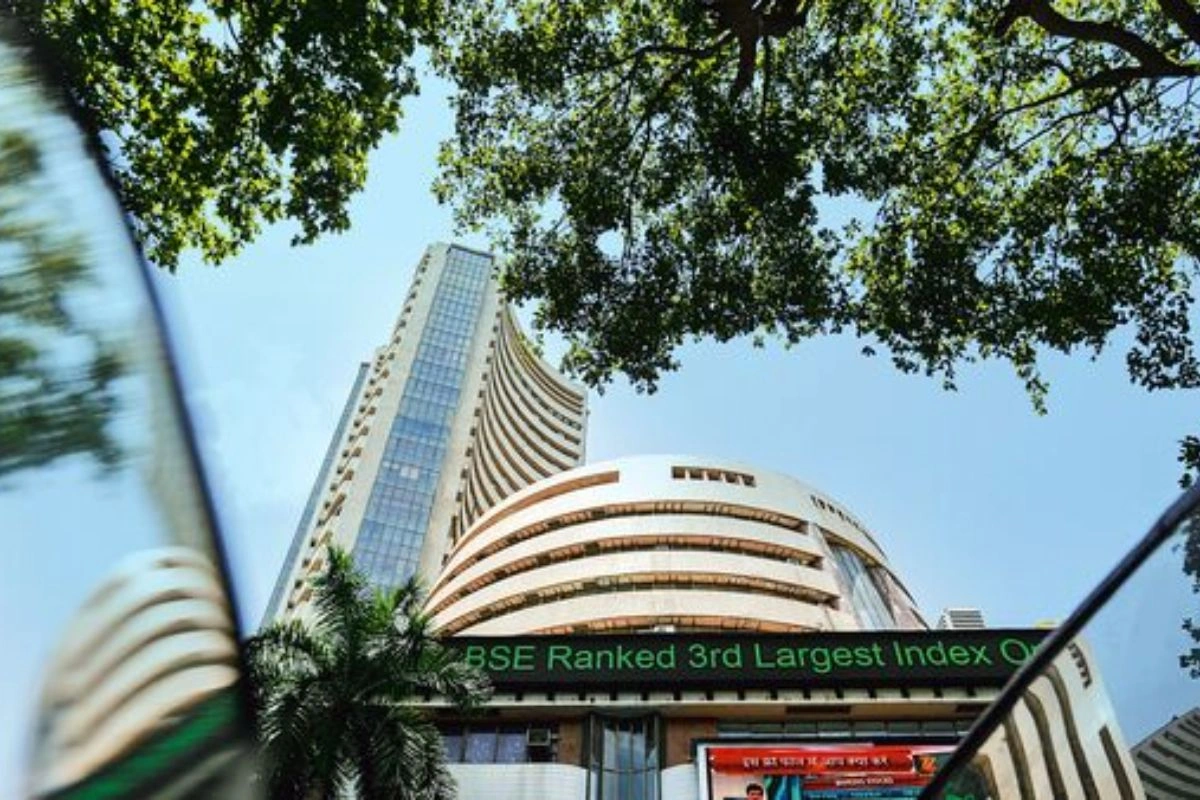

Indian stock markets closed the week with subdued performance as investors remained cautious amid global headwinds and awaited key domestic economic developments.

The Sensex ended at 81,721.08, while the Nifty closed slightly lower at 24,853.15 after a volatile trading week.

Global Factors Weigh On Indian Stock Market Sentiment

Rising US bond yields and growing concerns over America’s debt burden triggered foreign portfolio outflows, putting pressure on Indian equities.

Ajit Mishra, Senior Vice President of Research at Religare Broking Ltd, noted that these global factors significantly impacted investor sentiment across emerging markets.

“Speculation about progress in the US-China trade deal has also raised concerns about potential capital outflows from India or reduced foreign inflows, further dampening investor confidence,” Mishra added.

Domestic Developments Add To Caution

On the domestic front, mixed corporate earnings and delays in finalising the India-US trade agreement contributed to the cautious stance. Investors engaged in profit-booking amid uncertainty, leading to choppy trading and limited gains.

The market showed divergent trends across sectors. Real estate and metal stocks outperformed for the second consecutive week, offering some support to the broader market.

However, the auto, IT, and FMCG sectors recorded declines, dragging overall indices.

Within the broader indices, small-cap stocks posted a modest gain of nearly 0.5%, while the mid-cap index registered marginal losses.

Despite the overall subdued market tone, select defence stocks saw sustained buying interest, driven by sector-specific optimism.

Key Economic Triggers For Stock Market

Looking ahead, markets are expected to react to the Reserve Bank of India’s record dividend transfer of ₹2.7 lakh crore to the government, a move that could influence fiscal policy direction.

Additionally, investors will closely monitor the release of India’s industrial and manufacturing output data for April on May 28, alongside the Q1 GDP figures.

These data points are expected to provide critical insights into the country’s economic recovery momentum.

Also Read: Stock Markets End Week Higher On IT, FMCG, Bank Gains

To read more such news, download Bharat Express news apps