Picture Credit: PTI

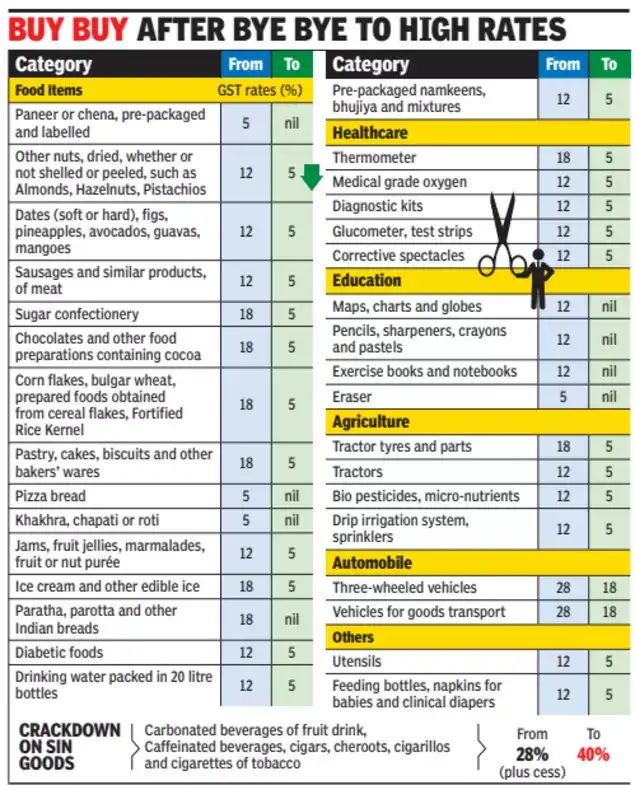

The latest Goods and Services Tax (GST) reductions on essential goods and medicines, effective from September 22, are expected to provide a much-needed lift to India’s consumption story.

The move comes at a crucial time, coinciding with the start of the festive season and following several quarters of subdued demand.

Industry leaders say the sweeping cuts on household staples will drive sales across the fast-moving consumer goods (FMCG) sector.

The government has moved products such as soaps, shampoos, hair oils, namkeen and other everyday items into the 5 per cent tax slab, making them more affordable for millions of households.

Mayank Shah, Vice-President at Parle Products, called the GST changes ‘a game changer’, noting that almost all food items, except so-called sin goods, will now attract just 5 per cent tax.

He said the cut is likely to generate a long-term revival in demand, although its impact on pricing may vary. “Bigger packs will see some price reductions, while smaller packs may pass on the benefit through increased grammage,” Shah explained.

According to industry experts, the new rates will reflect only on fresh stock entering the market after the implementation date, making re-stickering of existing inventory challenging.

Retailers could sell large packs already on shelves at discounted prices once the new regime comes into effect.

A Timely Boost for FMCG & Rural Markets

Consumers and the FMCG sector view the reduction in GST as a confidence booster and a growth enabler amid concerns over sluggish demand.

Mohit Malhotra, Chief Executive at Dabur, said the reform would act as a ‘powerful catalyst’ for consumption, especially in rural and semi-urban markets.

“It not only makes essentials like shampoos, soaps and toothpastes more affordable but signals a strong commitment to inclusive growth,” he added.

Mahesh Jaising, Partner & Indirect Tax Leader at Deloitte India, said significant rate reductions on common-use items reflect the ‘spirit of GST 2.0’ and will help reduce classification disputes.

Namit Puri, Managing Director & Senior Partner at BCG, said the cuts on essentials and electronics will unlock a new wave of consumption and investor confidence.

The GST overhaul also extends to healthcare. Prices of life-saving, cancer, rare disease and chronic therapies are expected to fall, easing the burden on patients.

Sudarshan Jain, Secretary-General of the Indian Pharmaceutical Alliance, described the reform as ‘a welcome and landmark step’.

The government reduced GST from 12 per cent to nil on 33 life-saving drugs and from 5 per cent to nil on three medicines used to treat cancer, rare diseases and severe chronic conditions.

The government lowered GST on other medicines from 12 per cent to 5 per cent, making treatment more affordable and accessible for millions of patients.

Also Read: GST Council Approves Two-Slab Structure; Hundreds Of Goods To Become Cheaper From September 22

To read more such news, download Bharat Express news apps