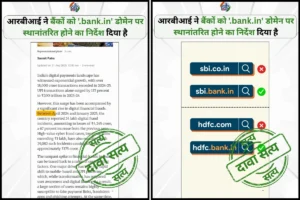

New Delhi: Amid worries about the unusually rapid growth in the loan categories, the Reserve Bank of India (RBI) tightened rules on banks and non-banking financial firms’ (NBFCs’) unsecured lending portfolios on Thursday.

The Reserve Bank of India (RBI) has taken notice of the steep increase in unsecured loans (mostly credit cards and personal loans) in Indian banks, which has exceeded the expansion in bank credit overall over the previous year by almost 15%.

Also Read: Saharasri Subrata Roy: A farewell to Five elements, Dignitaries attend Final Journey

According to a release, the RBI raised the risk weights for banks and NBFCs, or the amount of capital that banks must set aside for each loan, by 25 percentage points to 125% for retail loans.

According to the RBI, banks would be subject to the increased risk weight on personal loans as well as retail loans for NBFCs. However, loans secured by gold and gold jewellery, housing, education, and auto loans will not be included in this category.

On Thursday, the central bank raised the risk weights on credit card exposures for banks and non-bank financial institutions (NBFCs) by 25 percentage points, to 150% and 125%, respectively. Last month, RBI Governor Shaktikanta Das stated that the bank was keeping a careful eye out for early warning indicators of stress in a few rapidly expanding personal loan categories.

Afterwards, Reuters revealed that the RBI was especially worried about the increase in short-term personal loans, lasting three to four months, totalling up to 10,000 rupees.

To read more such news, download Bharat Express news apps