With high corporate confidence, economy’s expansion and technological advancement and innovation, India’s growth parameters are pointing in the right direction. Moreover, India’s rise as a global superpower was also well-demonstrated during Prime Minister Narendra Modi’s recent trip to the United States, where he addressed Congress, met with prominent business figures, and dined at the White House, Capital Group reported.

Over the past 10 years, India has experienced comparatively stable politics, and corruption is lower than it was a decade ago, allowing economic development to take precedence.

The Capital Group believes that India is poised for a period of growth, fuelled by significant expansion in direct and fixed asset investment which can be attributed to the maximum numbers of unicorns emerging in India. Capital Group is a private firm that aims to improve people’s lives through successful investing and take control of their financial futures. It is one of the world’s largest investment management organisations. According to the organisation, the following are the keynote points that make India appealing business destination compared with other emerging markets:

1. Reforms have set the stage for growth

Since Prime Minister Narendra Modi assumed office in 2014, he and his team have worked to bring about pro-business reforms that have sped up growth by facilitating the expansion of credit and bringing sizable portions of the economy into the formal sector, as evidenced by the significant improvements in the ease of doing business.

Under the leadership of PM Modi, several reforms and programmes like Aadhaar, a national Goods and Services Tax (GST), and Unified Payments Interface (UPI) are helping boost consumer lending, replacing an inefficient web of state taxes and facilitating electronic transactions and providing credit respectively as well as making the process more transparent.

Production-linked incentive programs designed to elevate India’s domestic manufacturing base are gaining traction too. PM Modi has delivered in terms of governance, infrastructure and economic programs. India is projected to become the world’s third-largest economy behind the United States and China by 2027, according to the International Monetary Fund. It’s currently the fifth largest, after Japan and Germany, as per Capital Group.

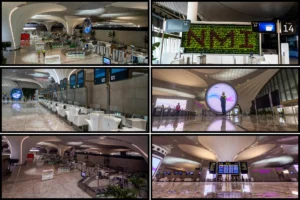

2. The infrastructure boom is real

The lack of infrastructure has been a major impediment to unlocking India’s true growth potential. Over the past five years, the government has pumped billions into building roads, railroads, airports and seaports. Capital Group has found that the construction of infrastructure, as well as more affordable housing, is finally happening.

3. Tailwinds for manufacturing are getting stronger

The playbook for the Indian government is twofold: ramp up capacity to serve the domestic population and over time become a larger player in export markets. Leaders also want to develop a supply chain ecosystem, as a wide array of product components are imported.

Manufacturing capacity is expanding for mobile phones, home appliances, computers and telecommunications equipment. PM Modi’s team has been aggressive in courting Japanese, Taiwanese and US companies to invest in new capacity.

Moreover, Apple is producing its iPhone 14 line in India, while Japanese companies Daikin and Mitsubishi Electric are teeing up investments to make air conditioners and related parts.

Local firms have been investing heavily to scale up businesses and tap into the rapidly growing domestic market.

Capital Group anticipates India will become a desirable location for companies looking to diversify their supply chains outside of China, a strategy commonly known as China plus one.

4. India’s equity market has been growing and should evolve

Within the MSCI Emerging Markets Index, India represents 14 per cent of the composite index, behind China at 29 per cent and Taiwan at 16.2 per cent.

Capital Group expects potential investment opportunities to increase, especially in the small-cap space given India’s economic trajectory.

India’s capital markets have seen a proliferation of initial public offerings (IPOs) in recent years. The types of companies going public — and those in the IPO pipeline — reflect its ongoing transformation.

India is now behind only the US and China in terms of the number of unicorns (unlisted companies valued at USD 1 billion) as of December 2022.

5. Investment opportunities span real estate, financials and industrials

According to Capital Group, real estate is projected to rise to nearly 15 per cent of India’s gross domestic product (GDP) by fiscal year 2031, up from 7 per cent currently.

The sector is undergoing a dramatic structural shift, which should boost profits. Government policies have helped reform corrupt practices and build trust in the home buying process among consumers.

Capital Group believes there is sufficient potential for loan growth to offset margin compression given the expansion of credit and robust economic growth.

6. China plus one: The chemicals industry sets a good example

The chemicals industry exemplifies how both governments and multinationals are turning to India to diversify manufacturing beyond China. Many chemical companies have come up over the past decade as the West sought to diversify its sourcing of both speciality and generic chemicals.

India has a sizable pool of trained scientists and chemical engineers, which has given it the competitive advantage of developing expertise in speciality and commoditized chemicals. This includes the ones that are being developed for use in solar panels, electric vehicle batteries, and semiconductors, all of which have increased capacity.

7. The energy transition could be transformational

Indian corporations are seeking to compete with China all along the value chain of clean energy, especially with green hydrogen.

The energy transition is potentially transformational for India. If done right, the payoff could be massive: India is a large importer of oil and gas, so more renewable power would make it more energy independent. It would also significantly boost its manufacturing base.

8. Demographics are the biggest advantage

While India will very likely benefit from Western countries exploring China-plus sourcing strategies, the bulk of economic growth will come from domestic consumption and investment. With a median age of 29 years, India in Capital Group’s view has one of the most attractive demographic profiles among the world’s largest economies and can reap benefits from its productive capacity, provided the right policies are in place. We have already seen that technological innovation combined with an improving regulatory and legal framework has put the nation’s economy on a path of 5 per cent to 6 per cent annualized growth, among the fastest of the world’s large economies, the Capital Group said.

9. Valuations are stretched but not insurmountable

India has historically traded at a premium on a relative price-to-earnings basis when it comes to investing in emerging markets. Currently, the market looks a little expensive by historical standards. The MSCI India Index trades at 20 times forward earnings versus its 10-year average of 18 times.

That said, Capital Group said it believes the fundamental outlook for India is arguably better than ever. The market has a lot going for it: It’s one of the world’s fastest-growing economies, inflation is under control, the government has been fiscally responsible, and corruption is lower than it was a decade ago. If Indian companies can deliver on earnings and cash flows, we think it’s possible the market can grow into these valuations.

(ANI)

To read more such news, download Bharat Express news apps