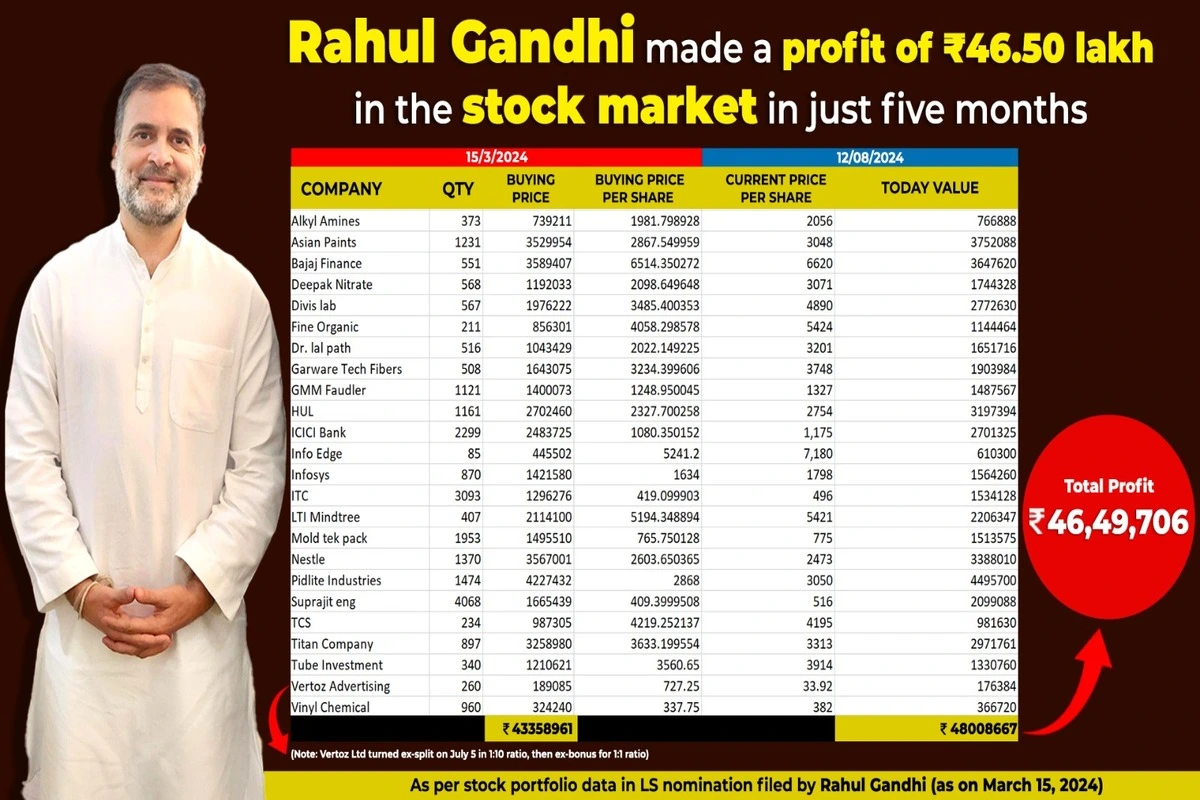

In a striking revelation, Congress leader Rahul Gandhi has reported a substantial gain of Rs 46.49 lakh from his stock investments over the past five months. This comes as Gandhi continues to voice concerns regarding the unprecedented growth of Indian stock markets during the Modi 3.0 administration.

Data analyzed by IANS indicates that Gandhi’s stock portfolio surged from approximately Rs 4.33 crore on March 15, 2024, to nearly Rs 4.80 crore by August 12, 2024. This profit was calculated based on the shares listed in his Lok Sabha nomination for the Rae Bareli constituency.

Gandhi’s portfolio is diversified, including prominent stocks such as Asian Paints, Bajaj Finance, Deepak Nitrite, Divis Labs, Hindustan Unilever, Infosys, ITC, TCS, Titan, and Tube Investments of India. Out of the 24 stocks in his portfolio, losses are currently incurre in four: LTI Mindtree, Titan, TCS, and Nestle India. Additionally, his investments also encompass smaller companies like Vertoz Advertising Ltd and Vinyl Chemicals.

Also Read: Sharad Pawar Urges Governments To Resolve Maratha Quota Issue, Calls For All-Party Meeting

Significantly, the number of shares Gandhi holds in Vertoz Advertising Ltd increased dramatically from 260 on March 15, 2024, to 5,200, following recent corporate actions.

Indian Stock Market In Modi’s NDA Government

The Indian stock market has experienced a remarkable boom during the third term of Prime Minister Narendra Modi’s NDA government, with the Sensex and Nifty hitting new highs in recent months.

In a related development, Gandhi has called for a Joint Parliamentary Committee (JPC) probe into allegations against the SEBI chief, leveled by the US short-selling firm Hindenburg. Gandhi asserts that these allegations threaten the integrity of the securities regulator and, by extension, the wealth of small retail investors.

Despite these concerns, the market appeared largely unaffected by the latest Hindenburg allegations, with benchmark indices ending relatively flat on Monday. Sushil Kedia, Founder and CEO of Kedianomics, dismissed the claims by Hindenburg as an attempt to undermine investor confidence in the Indian stock market. He mention that Hindenburg’s previous claims about the Adani Group debunked by a Supreme Court-monitored investigation, and SEBI had issued a show-cause notice to the firm.

Since the start of the year, the Sensex has delivered returns of approximately 11 percent, while the Nifty has risen by about 12 percent.

To read more such news, download Bharat Express news apps