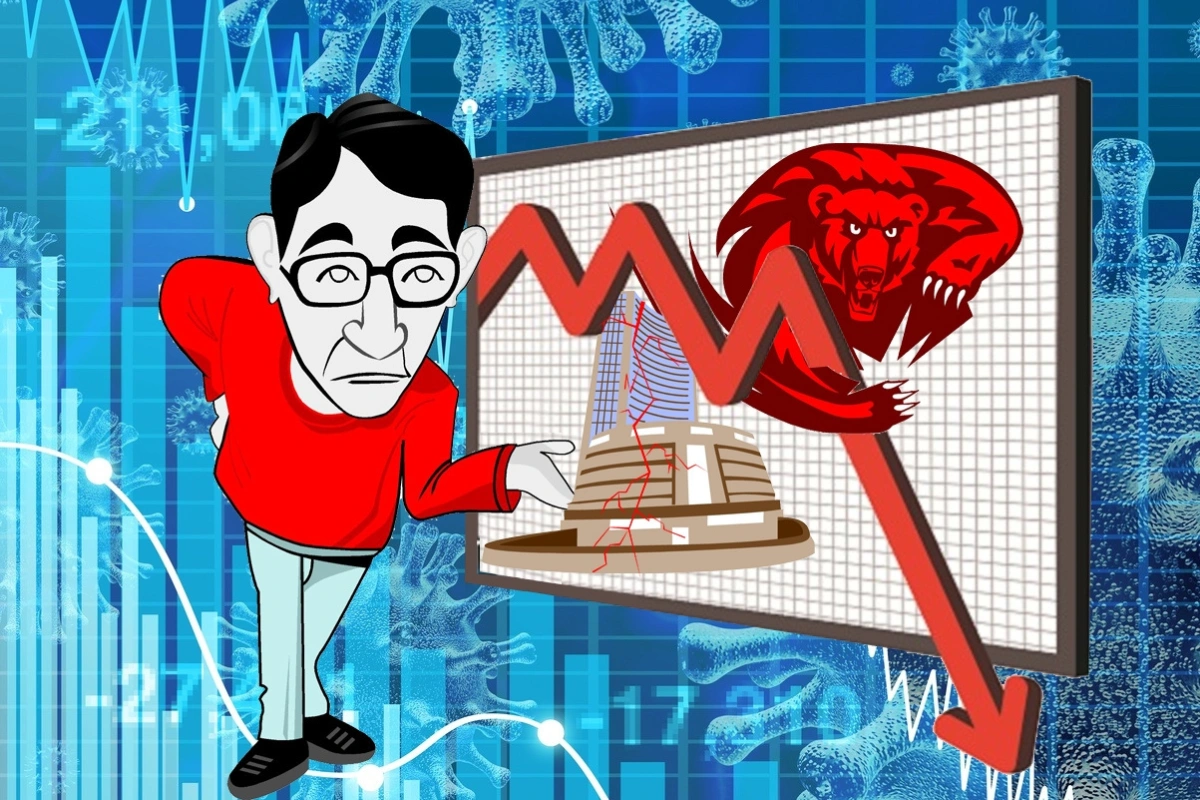

Indian equity markets started Tuesday’s session on a weak note, mirroring global trends. Early trade saw declines across IT, media, and private banking sectors.

At 9:35 AM, the Sensex was down 371.74 points (0.50%) at 73,743.43, while the Nifty slipped 104.25 points (0.46%) to 22,356.05.

The Nifty Bank index dropped 349.75 points (0.73%) to 47,867.05.

Meanwhile, the Nifty Midcap 100 fell 567.80 points (1.17%) to 47,872.30, and the Nifty Smallcap 100 lost 252.05 points (1.66%) to 14,946.10.

Market experts attributed the slump to concerns over US President Donald Trump’s inconsistent tariff policies, which have heightened economic uncertainty.

Analysts observed, “S&P 500 and Nasdaq declining by 2.6 per cent and 4 per cent, respectively yesterday is the market’s response to Trump’s tariffs and the possibility of US recession by the year end. We will have to wait and watch how the situation develops.”

Despite the correction, India’s markets have shown resilience compared to the US.

Over the past month, the S&P 500 has dropped 7.5%, whereas the Nifty has lost only 2.7%.

Additionally, the dollar index has declined from 109.3 at the start of Trump’s presidency to 103.71.

Among Sensex stocks, IndusInd Bank, Infosys, Zomato, Tech Mahindra, HCL Tech, M&M, Tata Motors, TCS, PowerGrid, NTPC, and Bajaj Finance led the losses.

Conversely, ICICI Bank, Maruti Suzuki, Sun Pharma, ITC, Adani Ports, and Titan recorded gains.

Earlier, on Monday, US markets saw sharp declines, with:

- The Dow Jones falling 2.08% to 41,911.71,

- The S&P 500 dropping 2.70% to 5,614.56, and

- The Nasdaq plunging 4.00% to 17,468.32

Asian markets mirrored the negative sentiment, with indices in Japan, Seoul, Bangkok, China, Jakarta, and Hong Kong trading lower.

Foreign institutional investors (FIIs) remained net sellers, offloading equities worth Rs 485.41 crore on 10 March.

In contrast, domestic institutional investors (DIIs) purchased Rs 263.51 crore worth of equities.

Also Read: IndusInd Bank’s Strong Growth & Stability Highlight Positive Long-Term Prospects

To read more such news, download Bharat Express news apps