Indian Stock Market Opens Higher As RBI MPC Meeting Commences

Indian stock markets opened in positive territory on Monday as the RBI’s MPC meeting commenced to review the key policy rate.

GST Rate Cuts Can Ease Inflation, Pave Way For RBI Repo Rate Cut: HSBC Report

The recent GST rate cuts can further lower inflation if companies pass on the benefits to consumers, an HSBC report said on Thursday.

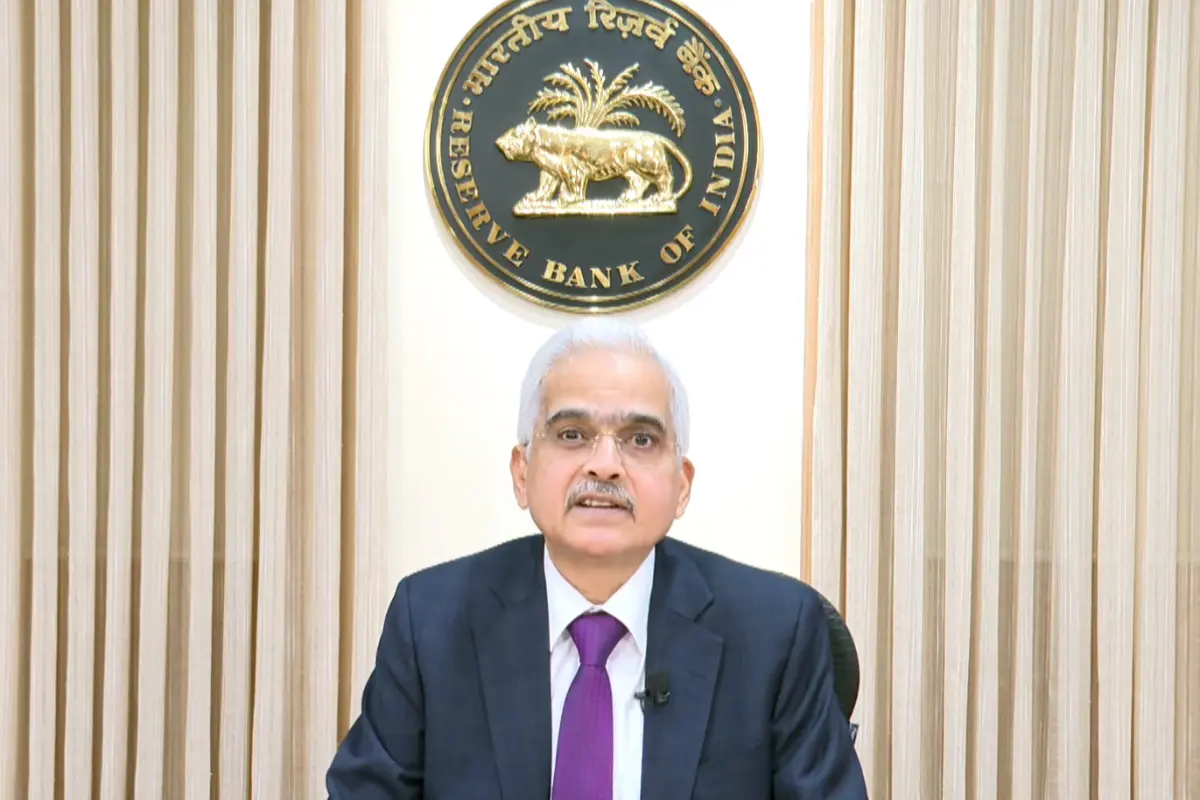

RBI Holds Repo Rate At 5.5%: Key Highlights From The Latest Policy Meet

The Reserve Bank of India (RBI), under Governor Sanjay Malhotra, has announced that the repo rate will remain unchanged at 5.5%.

RBI Likely To Cut Repo Rate By 25 Bps In August MPC Meet: Report

The Reserve Bank of India is expected to slash the repo rate by 25 basis points in the Monetary Policy Committee (MPC) meet in August.

Sensex, Nifty Trade Flat After RBI Cuts Repo Rate By 25 Bps

On Friday, the Indian stock market traded almost flat after the Reserve Bank of India (RBI) announced a 25 basis points (bps) cut in the repo rate.

Indian Stock Market Ends Flat After RBI MPC Decisions

On Friday, the Indian stock market closed flat following the RBI's Monetary Policy Committee (MPC) decisions on the repo and CRR rates.

RBI Maintains Repo Rate at 6.5%; Projects Economic Growth For FY25

The RBI has opted to keep the repo rate steady at 6.5% for the 11th straight time, reinforcing its neutral monetary policy stance.

RBI Keeps Repo Rate Steady At 6.5%; Maintains GDP Growth Forecast

On Wednesday, the RBI's MPC decided to maintain the repo rate at 6.5% and upheld its GDP growth forecast for India at 7.2% for FY25.

RBI Likely To Keep Repo Rate Unchanged Amid Geopolitical Tensions: Experts

Experts expect the RBI to maintain the repo rate as its Monetary Policy Committee begins a three-day meeting amid global uncertainties.

RBI Maintains Repo Rate At 6.5% Amid Balancing Act Between Growth & Inflation

In a move to sustain economic growth while keeping inflation in check, the RBI opted to maintain the key policy repo rate at 6.5%.