PM Modi Launches GST ‘Savings Festival’; Urges Citizens To Celebrate Benefits

PM Modi launches GST ‘Savings Festival’ in Arunachal Pradesh, offering tax relief and supporting households, traders, and entrepreneurs.

PM Modi Engages With Arunachal Entrepreneurs; Launches Major Development Projects

Prime Minister Modi met traders and industry leaders in Arunachal Pradesh to discuss GST rate cuts and unveiled multi-crore projects boosting infrastructure and energy.

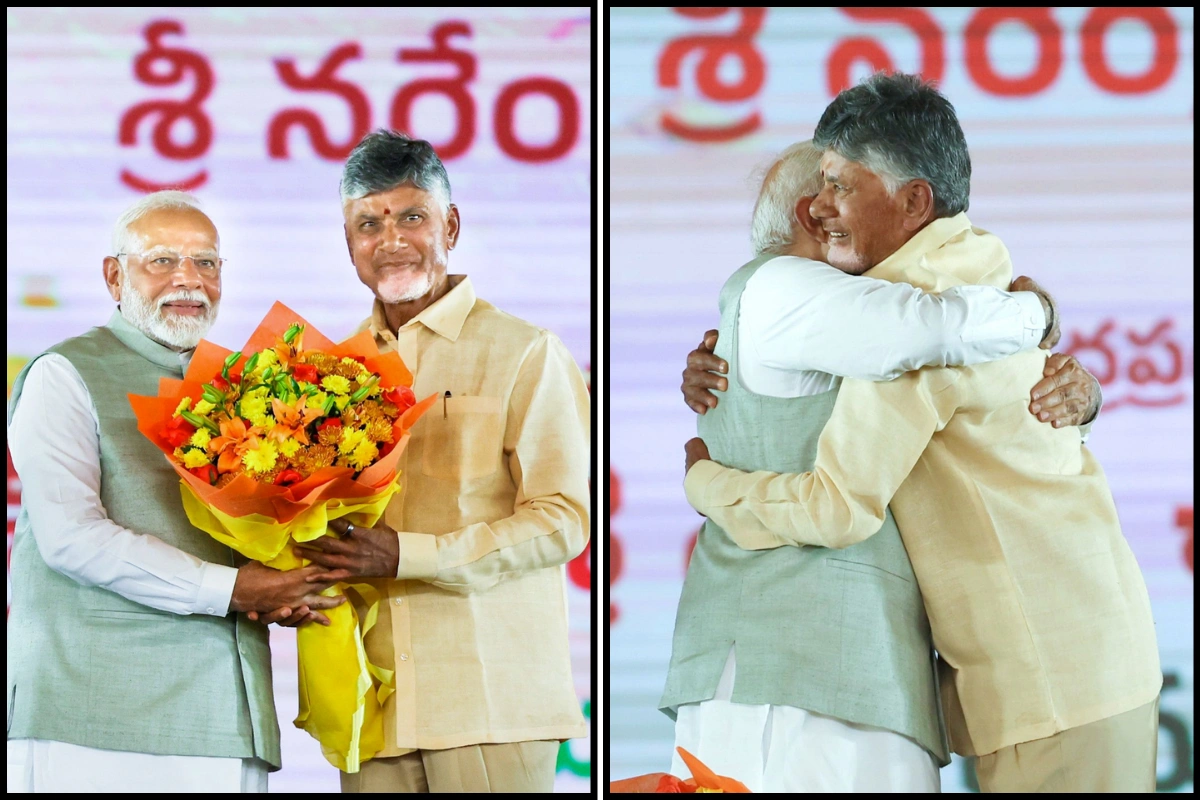

Chandrababu Naidu Congratulates PM On GST 2.0; Calls Reform Citizen-Centric

Chandrababu Naidu hails PM Modi’s GST 2.0 and ‘GST Bachat Utsav’, urging citizens to embrace Swadeshi products.

PM Modi Urges Joint Effort On Swadeshi To Realise Aatmanirbhar Bharat

PM Modi urges citizens and states to embrace Swadeshi and work with the Centre to achieve self-reliant India, linking it to upcoming GST reforms.

PM Modi Recalls Pre-GST Chaos As New Reforms Take Effect

PM Modi cites a French firm’s odd Bengaluru–Hyderabad route to show India’s old tax woes and hails GST for unifying the market ahead of reforms.

PM Modi Launches Nationwide ‘GST Utsav’ Promising Savings And Simpler Taxes

PM Modi launches nationwide ‘GST Utsav’ from Navratri, touting lower rates and a two-slab structure to cut prices and boost industry.

Indian Stock Market Ends Week Higher After India-US Trade Talks And Fed Rate Cut

Indian stock market ends the week with gains as India-US trade talks resume and the US Fed cuts rates; Adani stocks surge on strong buying.

Nifty Posts Weekly Gain Of 1.32% As GST Reforms & H2 Earnings Boost Mood

Nifty rises 1.32% this week, driven by GST reform hopes and expectation of stronger H2 FY26 earnings, led by the auto and IT sectors.

JLR Reduces Prices Across Luxury SUV Range In India Following GST Cut

JLR cuts prices by up to ₹30.4 lakh on Range Rover, Defender and Discovery after GST revision on luxury cars.

No GST Transition Benefits From 22 Sept; CBIC Calls Viral Social Media Post Misleading

CBIC on Sunday dismissed as ‘false and misleading’ a viral message claiming new GST transition benefits from 22 September.