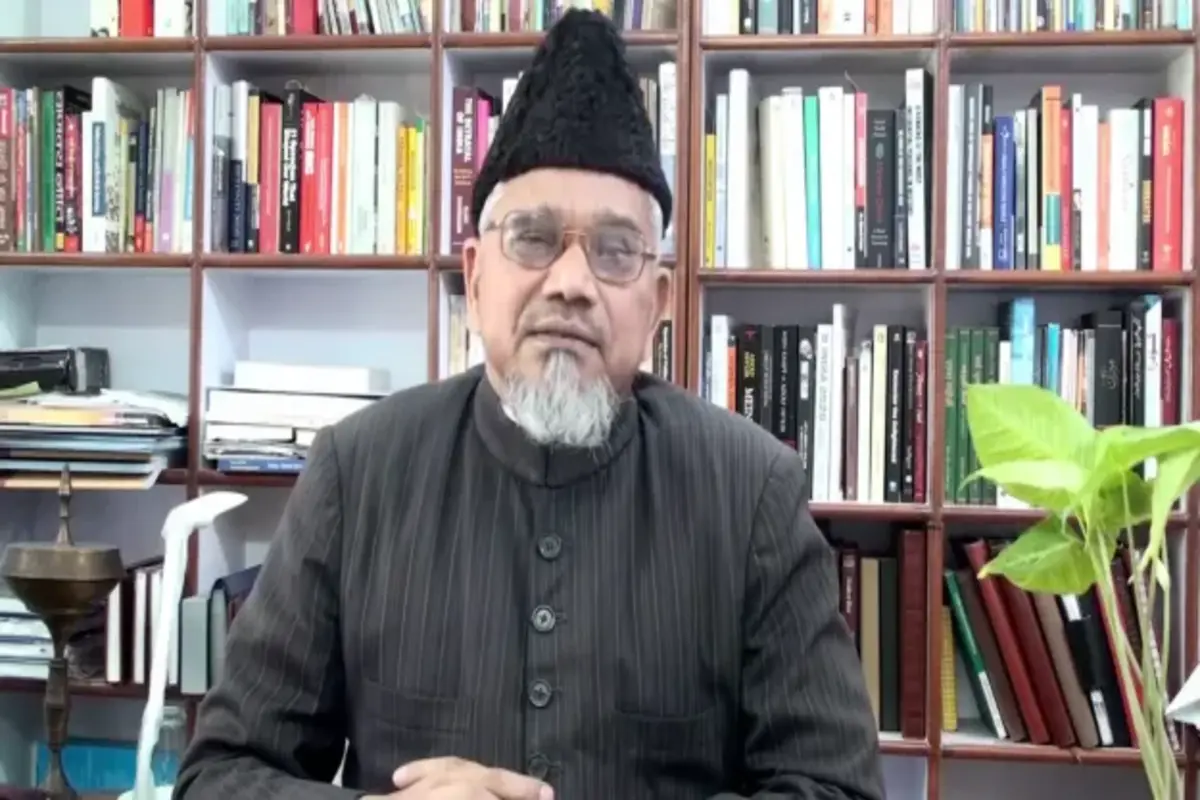

The Vice President of Jamaat-e-Islami Hind, Prof Salim Engineer has called the Union Budget disappointing for the poor, the Marginalized , SC & STs, and religious minorities of India. In a statement to the media, the JIH Vice President said, “Jamaat-e-Islami Hind (JIH) would like to reiterate that the Union Budget is a critical exercise that drives the economic policies of the country and should be used to cater to the needs of the common man along with stabilizing the macroeconomic challenges. There are a few positives like adherence to fiscal prudence for long-term debt sustainability, assumed tax buoyancy is kept at 1 despite last year’s tax buoyancy of 1.4, addressing financial stability by increasing capital gains and securities transaction taxes, sending a clear signal to keep asset prices aligned with economic fundamentals and the reduction or elimination of customs duties across several sectors aims to make Indian exports more competitive by effectively lowering export taxes.”

Prof Salim Engineer said, “Despite these positives, we feel that the Budget 2024-25 does not offer any solace to the poor, the marginalized, SC & STs and religious minorities of India. It seems that the Budget aims to benefit only one class of society. There is an increase in health allocation this year, but it is still 1.88% of GDP. Despite increasing the allocation to education, it is just 3.07% of GDP. JIH demands that the allocation to health should be at least 4% and for education 6% of GDP. The Budget has been insensitive to the government’s slogan of “Sab ka Vikas” as it has drastically reduced the budgetary allocation to many schemes for minorities. It is quite unfortunate that the Ministry of Minority Affairs MoMA has an allocation of just 0.06% of the total budget. We expect at least 1% of the budget to be spent on the welfare of minorities.”

Also read: Explained: How Much Income Tax You Have To Pay After Modi 3.0’s First Budget

The JIH Vice President stated, “We feel that this Budget is contractionary in nature. We need an expansionist approach. Revenue is increasing substantially still the increase in expenditure is negligible, this contractionist approach will further aggravate the situation of unemployment, inflation, and inequality. Fiscal prudence is required but not at the cost of being insensitive to the needs of the people. Government expenditures have been slashed resulting in a decrease in allocation for the social sector. For example, the MGNREGA scheme allocation has not been hiked when unemployment is historically high. Continuous neglect of MGNREGA is highly regressive. Another worrying aspect of the Budget is that various subsidies have been cut. For example, food subsidy, fertilizer subsidy and petroleum subsidy all have been reduced. This is highly irrational and condemnable. Despite alarming level of inequality, budget is supportive to rich and unjustly tilted towards big corporates. The coprporate tax revenue (17%) is less than that from income tax (19%). Indirect tax is still very high burdening the poor and the middle class. In the name of employment generation under the new employment incentive scheme, corporates are being heavilt subsidised.”

The JIH Vice President averred, “We are of the opinion that to fund welfare, measures to curb corruption are needed, along with higher direct taxes on the wealthy and reduced indirect taxes to alleviate inflation’s impact on the poor. The government should implement special measures and policies for the welfare of Dalits, backward classes, SCs & STs and minorities, particularly Muslims, with concrete plans and adequate budgets rather than symbolic gestures. Further, 19% of our budget is going towards interest payments. Borrowing and other liabilities make up 27% of our budget. We must try and reduce our outlook towards debt and try to move towards an interest-free economy. Vicious rates of interest on loans should be strictly curtailed. We urge the government to promote interest-free microfinance and intrest-free banking on a large scale. This will boost the economy, generating employment and reduce social unrest.”

To read more such news, download Bharat Express news apps