The Central Action Plan (CAP) for 2024-2025, developed by the Central Board of Direct Taxes (CBDT) under the Ministry of Finance, Government of India, outlines a strategic framework for the management of India’s direct taxation system. The CAP is pivotal in driving the government’s vision of Viksit Bharat by 2047, focusing on enhancing tax administration, optimizing revenue collection, and improving taxpayer services. This comprehensive plan aims to create a more efficient, transparent, and taxpayer-friendly system. Here, we delve into the key aspects of the CAP 2024-25.

KEY OBJECTIVES

Enhanced Revenue Collection

The CAP primarily aims to set ambitious yet achievable budget collection targets and allocate them to various regions. Each Principal Chief Commissioner of Income Tax (Pr. CCIT) region receives specific goals based on revenue potential and past performance. This regional allocation ensures a balanced and focused approach to revenue collection.

Reduction & Cash Collection in Arrear Demand

The CAP addresses the significant challenge of arrear demand, which has seen a steep rise from Rs. 24,51,099 crores as of April 1, 2023, to Rs. 43,00,232 crores as of April 1, 2024. The plan emphasizes concerted efforts to reduce this demand, setting region-wise targets and utilizing Demand Facilitation Centres (DFC) to assist Jurisdictional Assessing Officers (JAOs) in resolving outstanding demands.

Litigation Management

Effective management of tax litigation is critical to reducing the backlog of cases and ensuring timely resolution of disputes. The CAP introduces measures to streamline the litigation process, thereby facilitating quicker resolutions and reducing the burden on the judicial system.

Service Delivery Standards & Grievance Redressal

Improving taxpayer services is a cornerstone of the CAP. It focuses on resolving grievances received through the Centralized Public Grievance Redress and Monitoring System (CPGRAMS) within stipulated timelines. The plan sets clear timelines for key services, such as issuing refunds, rectifying applications, and giving effect to appellate orders. Adherence to the Taxpayers’ Charter, which outlines service delivery standards and taxpayer rights, is emphasized to enhance overall taxpayer satisfaction.

Focus on Assessment

The CAP aims to strengthen and streamline assessment processes across various charges, including Faceless, Jurisdiction, Central, International Tax, and Exemption charges. This involves capacity building and training initiatives to ensure a knowledgeable and efficient workforce.

Human Resource Management

A robust human resource framework is crucial for effective tax administration. The CAP focuses on capacity building and performance monitoring to ensure a responsive and competent workforce capable of meeting the demands of modern tax administration.

DEATILED INSIGHTS

Allocation of Budget Targets

The allocation of budget targets for direct tax collection. It provides a breakdown of targets across various regions and tax categories, emphasizing the need for systematic and strategic efforts to meet these goals.

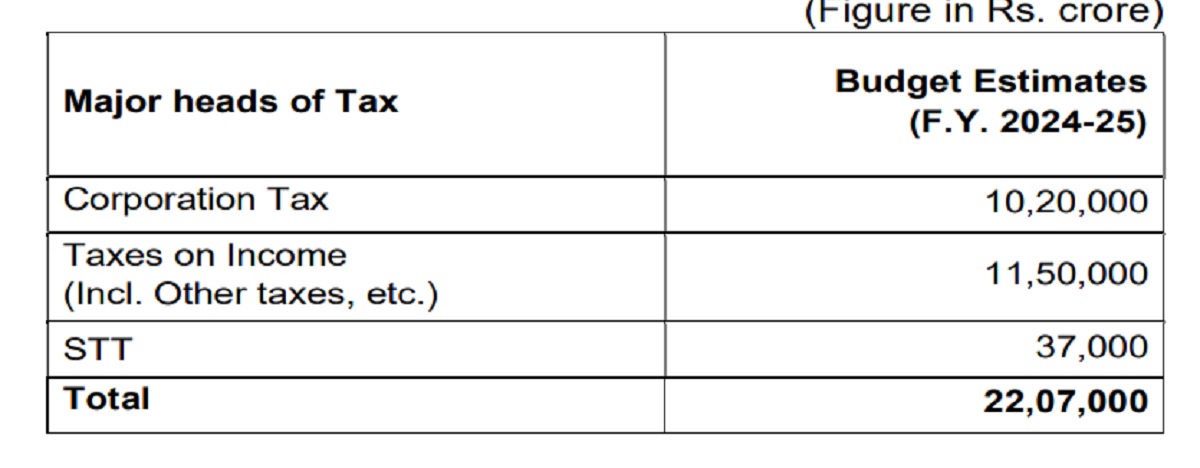

India’s FY24-25 Budget Estimates: Corporation Tax & Income Tax Lead Revenue Generation:

- Corporation Tax: ₹10,20,000 crore

- Taxes on Income: ₹11,50,000 crore

- STT: ₹37,000 crore

- Total Tax Revenue: ₹22,07,000 crore

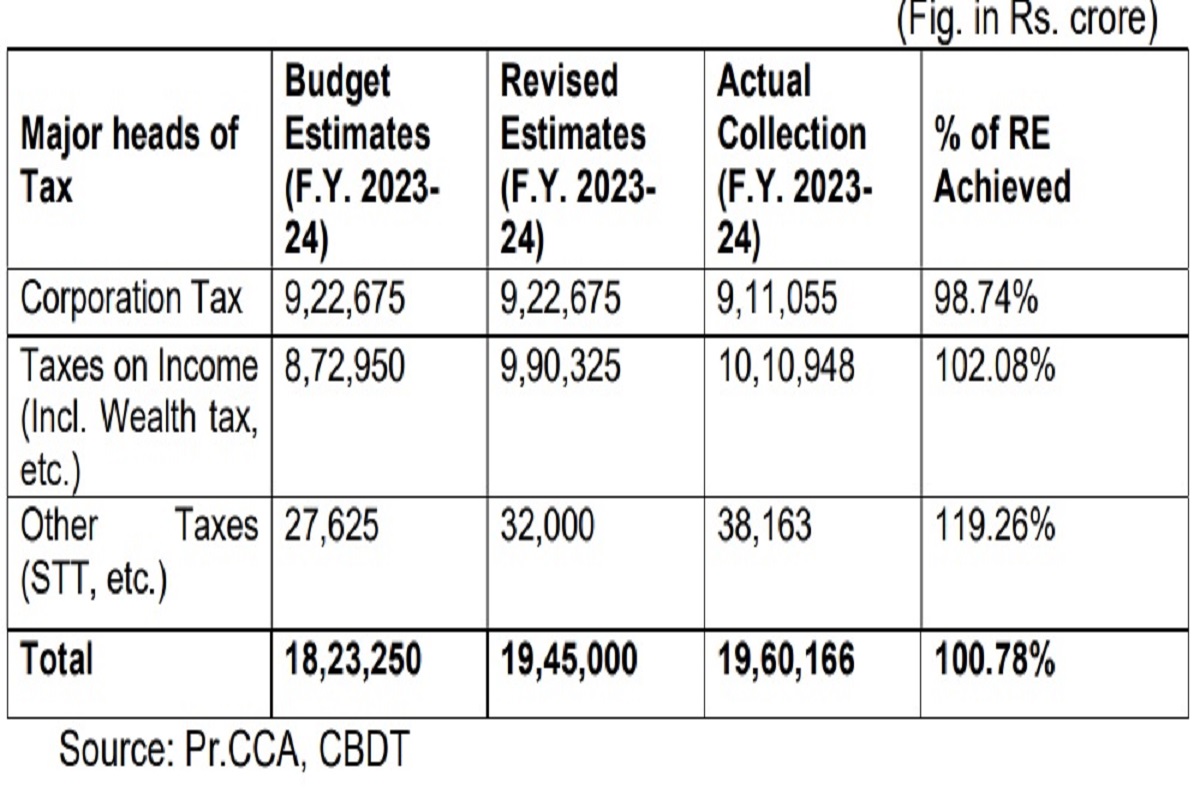

Government Exceeds Tax Collection Targets, Surpassing Revised Estimates:

- Government achieves 100.78% of total tax collection target for FY23-24.

- Corporation Tax and Taxes on Income contribute significantly to the overall achievement.

- Other Taxes outperform expectations, achieving 119.26% of revised estimates.

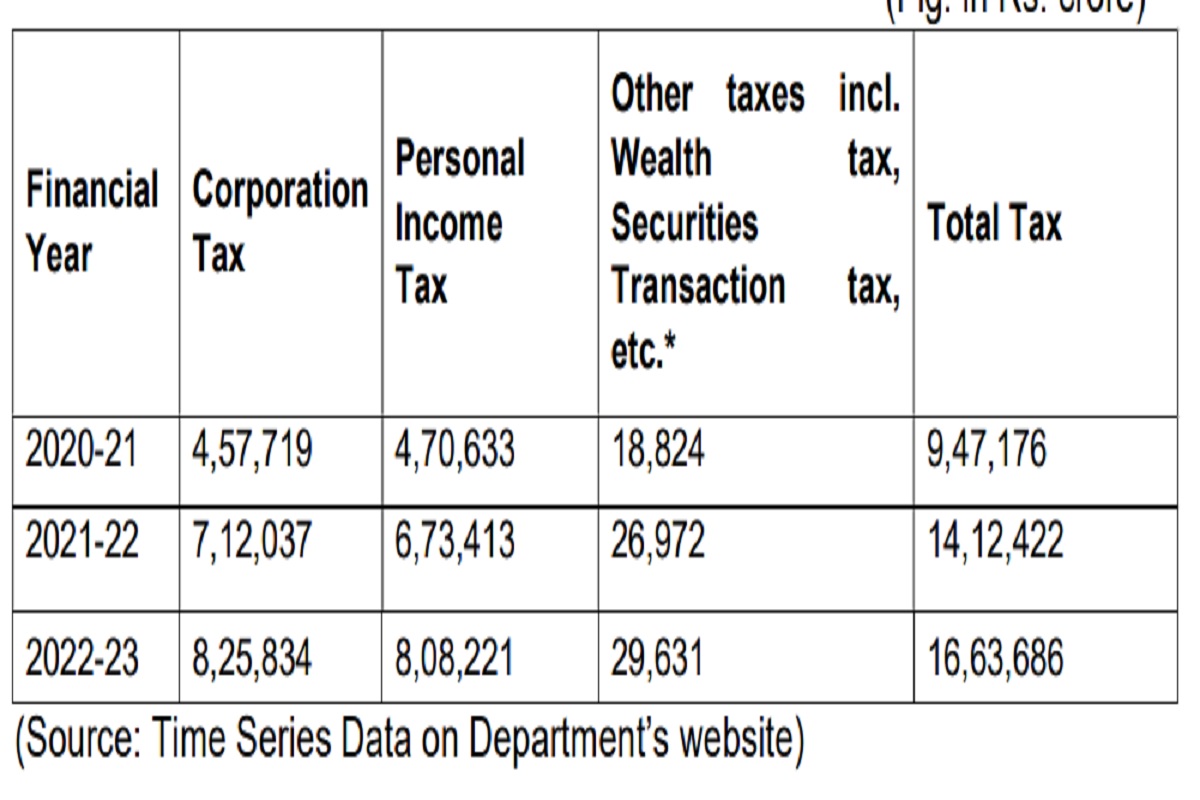

Tax Collections Across Categories Surge in Three Years:

Significant increase in tax collection: Total tax collection has risen from ₹9.47 crores in 2020-21 to ₹16.63 crores in 2022-23.

Dominance of Corporation Tax and Personal Income Tax: These two categories contribute the most to the total tax collection.

Steady growth in other taxes: Including Securities Transaction Tax and others, this category has shown consistent growth over the three years.

Reduction & Cash Collection Out of Arrear Demand

What is Arrear Demand?

Arrear demand refers to the outstanding amount of money that is overdue and owed by a debtor. In a financial or tax context, it typically represents the unpaid bills, taxes, or other financial obligations that have not been settled by the due date. These arrears can accrue interest or penalties until they are paid off. In accounting, an arrear demand is often highlighted in financial statements to indicate the amount that needs to be collected from debtors.

In context to income tax, Arrear Demand refers to the amount of tax that a taxpayer owes to the tax authorities which has not been paid by the due date.

The figures of arrear demand have been increasing over the past years and it has been a cause of concern. The arrear demand, including demand not fallen due as on 31st March, 2024 has increased from Rs. 24,51,099 crores as on 01.04.2023 to Rs. 43,00,232 crores as on 01.04.2024. This is a very steep rise which requires immediate and urgent action. Keeping in view the past trends of the arrear demand and cash collections, it is imperative that concerted efforts continue to be made to reverse the trend of increasing arrear demand and to initiate the process of reducing the figure to more manageable levels

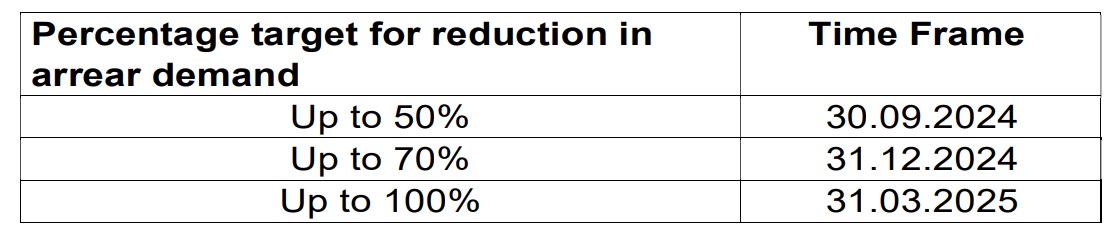

Aggressive Target Set for Arrear Demand Reduction:

Time-bound goals:

- Up to 50% reduction by September 30, 2024

- Up to 70% reduction by December 31, 2024

- Complete clearance (100%) by March 31, 2025

Litigation Management

Strategies for managing tax litigation are discussed. The aim is to reduce the backlog of cases and expedite the resolution of tax disputes through streamlined processes.

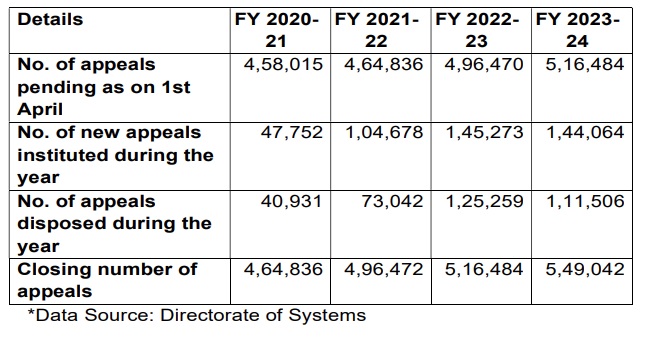

Appeal Backlog Rises Steadily:

Increasing Pending Appeals: The number of appeals pending as of April 1st has grown consistently from FY 2020-21 to FY 2023-24.

Rising New Appeals: The number of new appeals instituted each year has also increased, contributing to the growing backlog.

Disposal Rate Fluctuates: While the number of appeals disposed of each year varies, it has not kept pace with the influx of new appeals.

Closing Number Climbs: The total number of pending appeals at the end of each financial year has steadily increased.

Enhancing Tax Administration; Strategic Focus on Efficiency, Compliance, & Transparency

Service Delivery & Grievances: Focus on improving service standards and grievance redressal, adhering to timelines and the Taxpayers’ Charter.

Faceless Charges: Enhancements in faceless assessment processes to boost efficiency and transparency.

Jurisdictional & Central Charges: Measures to improve coordination and efficiency across regions.

International Taxation & Transfer Pricing: Compliance with global standards in international taxation and transfer pricing.

Exemptions: Streamlining tax exemption processes to reduce misuse.

Tax Deducted at Source (TDS): Administration improvements to enhance compliance and reduce evasion.

Widening Tax Base: Strategies to broaden the tax base and increase taxpayer coverage.

Intelligence & Investigation: Focus on combating tax evasion through intelligence and criminal investigations.

Exchange of Information: Emphasis on international cooperation under tax treaties.

Computer Operations: Use of technology to enhance tax administration efficiency.

Communication Strategy: Improving taxpayer awareness and engagement.

Human Resource Management: Capacity building and performance monitoring for a competent workforce.

Vigilance: Enhancing vigilance and accountability within tax administration.

Expenditure Budget & Infrastructure: Allocation and development to support tax administration activities.

Miscellaneous: Includes actions on the Global Entry Programme and antecedent verification.

Official Language: Compliance with linguistic policies in tax administration.

The Central Action Plan 2024-25 represents a comprehensive roadmap to elevate India’s direct tax administration. By focusing on key areas such as revenue collection, arrear demand management, litigation, service delivery, and human resource development, the plan however aims to create a more robust, efficient, and taxpayer-friendly system. The CBDT’s commitment to continuous improvement and innovation is evident in this plan, which seeks to address current challenges while preparing for future demands. The successful implementation of the CAP 2024-25 will play a crucial role in achieving the government’s fiscal objectives and fostering a conducive environment for economic growth.

Also Read: APSEZ Reports Record Profits & Expands Global Footprint

To read more such news, download Bharat Express news apps