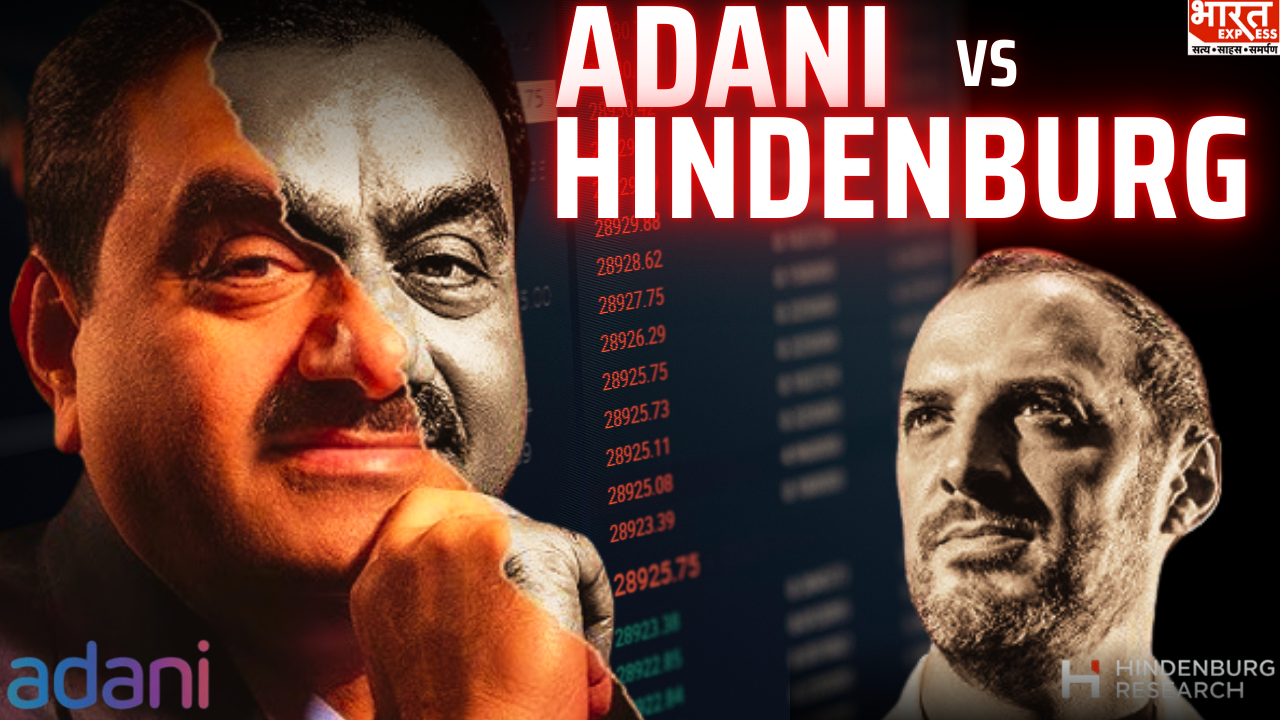

Adani vs Hindenburg Research

An ongoing 18-month conflict between Hindenburg Research and the Adani Group has intensified, with the U.S.-based short-seller recently accusing the head of India’s market regulator, SEBI, of a conflict of interest. Here’s a breakdown of the key elements:

Who Are Adani and Hindenburg?

Gautam Adani:

Gautam Adani began his career as a commodities trader and eventually built a vast business empire. Before the release of Hindenburg’s report, Adani had risen to become Asia’s richest person. His companies span industries such as ports, power generation, airports, mining, renewables, media, and cement.

Hindenburg Research:

Founded in 2017 by Nathan Anderson, Hindenburg Research specializes in forensic financial analysis, focusing on equities, credit, and derivatives. The firm has a track record of uncovering corporate misconduct and placing bets against the companies it investigates.

The Initial Allegations

In January of last year, Hindenburg Research disclosed that it held short positions in Adani Group companies through U.S.-traded bonds and non-India-traded derivatives. The firm published a report accusing Adani of improperly using tax havens and raising concerns about the company’s high debt levels.

Adani Group’s Response:

The Adani Group dismissed Hindenburg’s allegations, calling them “unsubstantiated speculations” and the report itself “baseless.”

Also read: Hindenburg Effect Fades: Adani Group Shares Surge As Market Gains 300 Points

Impact of the Hindenburg Report

Hindenburg’s report triggered a massive selloff, wiping out over $150 billion from the market value of Adani’s publicly traded companies. Although the shares have partially recovered, they remain approximately $35 billion below their pre-report levels.

Recovery Efforts:

The Adani Group took steps to restore investor confidence, including bringing in investors like Abu Dhabi’s International Holding Company and investment firm GQG. In July, Adani Energy Solutions successfully raised $1 billion, marking the group’s return to the equity capital market. Adani Enterprises, the group’s flagship company, is also reportedly considering raising additional funds.

Hindenburg’s Latest Allegation

In a recent development, Hindenburg Research accused SEBI Chairperson Madhabi Puri Buch of having a conflict of interest. According to the short-seller, Buch and her husband previously invested in offshore funds connected to the Adani Group. Hindenburg suggests that this investment may have influenced SEBI’s handling of the Adani investigation.

Details of the Allegation:

Hindenburg claims that Buch and her husband invested in a sub-fund of the Bermuda-based Global Opportunities Fund, which was reportedly used by entities linked to the Adani Group. The investments were made in 2015 and exited in 2018, before Buch became SEBI chairperson.

Also read: Emkay Global Recommends ‘Buy’ For Adani Green Energy; Sees 50% Potential Gain

Response from Buch and SEBI

Madhabi Puri Buch responded to the allegations, stating that the investments were made in a personal capacity before her tenure as SEBI chairperson. She also emphasized that all necessary disclosures had been made. The IPE-Plus Fund 1, the specific fund in which Buch invested, confirmed that it had not invested in any Adani Group shares.

SEBI’s Position:

SEBI supported Buch’s stance and urged investors to remain calm and exercise caution. The regulator also provided an update on its investigation into the Adani Group, stating that it had concluded probes into 23 out of 24 matters. Several Adani Group companies have received show cause notices from SEBI, indicating possible disciplinary actions.

What’s Next?

Hindenburg’s allegations and SEBI’s ongoing investigations have kept the spotlight on the Adani Group. The situation remains fluid, with further developments likely as SEBI moves closer to concluding its investigations and potential disciplinary actions.

To read more such news, download Bharat Express news apps